Peak Money: a permanent change

the "recession" that will not end in our lifetime

bailouts, billionaires and the end of economic "growth"

on this page:

- Sustainability requires a steady state economy

- Peak Money and the Global Financial Crash

- Growth based economics vs. Sustainability - Steady State

- Smart Growth: having a nice seat on the Titanic

www.kunstler.com/mags_diary23.html

February 11, 2008

Burning Down the House

by James Howard Kunstler

"This is not so much financial bad weather as financial climate change"

The Very Big Corporation of America

from Monty Python's The Meaning of Life

The only surprise about the global financial crash is that it took this long for it to start, since something that is “unsustainable” is not merely a bad idea, but unable to continue indefinitely. Most media reports on money problems ignore the root causes and avoid even approaching needed solutions.

Our monetary system is based on debt and compound interest, which results in an ever expanding amount of “money” chasing dwindling natural resources on our finite planet.

The geologist M. King Hubbert, who invented the methods to model the rise and fall of fossil fuels, wrote eloquently about how sincerely sustainable solutions would require money that was no longer based on debt and instead used natural resources as the basis for a steady state economic system. This would be considerably more sophisticated than the old gold standard.

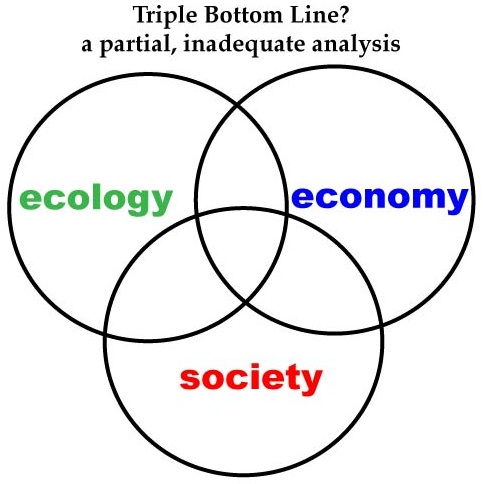

Many well-meaning environmentalists promote the concept of the “triple bottom line,” an effort to include social justice and ecology into economic decisions. But the environment is not a co-equal concept - energy creates money, not the other way around. Former World Bank economist Herman Daly has written eloquently about how “sustainable growth” is an oxymoron, and a steady state economic model would be needed for genuine sustainability.

As collapse becomes more obvious, there has been an increase in distracting greenwash to confuse concerned citizens -- “sustainabullshit.”

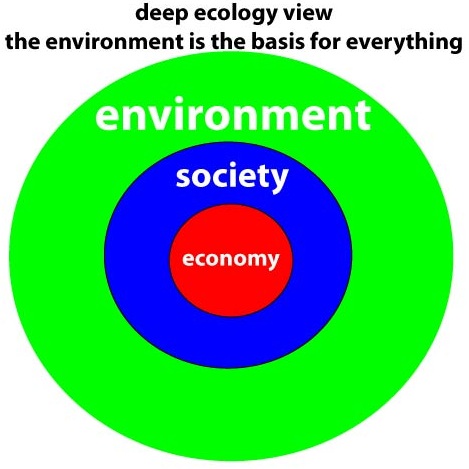

Steady state economics teaches that the economy is a subset of the environment, not co-equal concepts. As we shrink the natural world, use up non-renewable petroleum and mineral ores, and deplete renewable resources faster than they can regenerate, it is obvious that the "economy" based on exponential growth, compound interest, debt and fiat currency cannot continue. Unsustainable does not mean something is a bad idea, it means it cannot continue indefinitely. Decades of warnings about overshoot now are shown to be largely correct.

Exponential growth cannot continue forever on a finite

planet:

A steady state economy is needed for sustainability, since a money supply cannot expand forever.

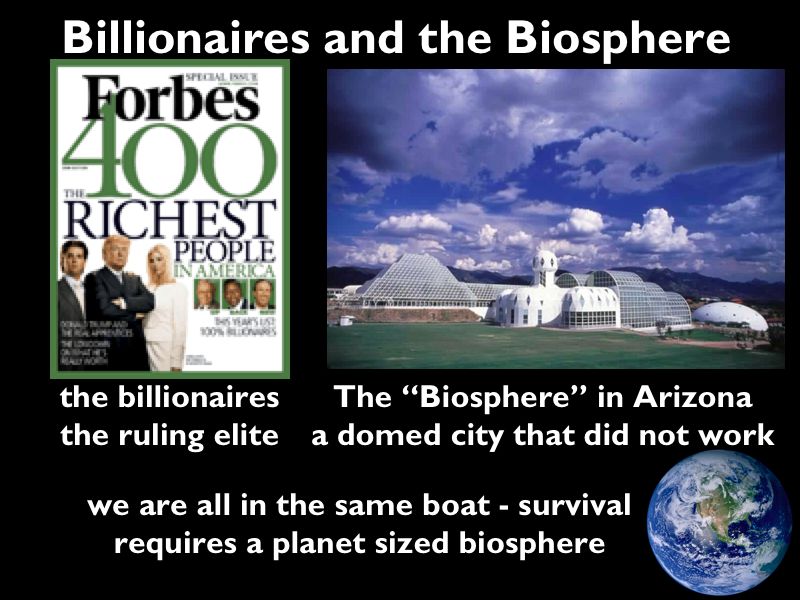

The global financial crash, as important as it is, pales in comparison to the destruction of the biosphere upon which all life depends.

There are no jobs on a dead planet.

Only after the last tree has been cut down

Only after the last river has been poisoned

Only after the last fish has been caught

Only then will you find that money cannot be eaten

-- Cree Indian Prophecy"You will change nothing until you change the way that money works"

-- paraphrase of comments from M. King Hubbert"Growth for the sake of growth is the ideology of the cancer cell."

-- Edward Abbeywww.kunstler.com/mags_diary23.html

February 11, 2008

Burning Down the House

by James Howard Kunstler

"This is not so much financial bad weather as financial climate change""The economists all think that if you show up at the cashier's cage with enough currency, God will put more oil in the ground."

-- Kenneth Deffeyes, petroleum geologist and associate of M. King Hubbert"The greatest shortcoming of the human race is our inability to understand the exponential function."

-- Dr. Albert Bartlettcommunism forgets that life is individual. Capitalism forgets that life is social, and the kingdom of brotherhood is found neither in the thesis of communism nor the antithesis of capitalism but in a higher synthesis. It is found in a higher synthesis that combines the truths of both. Now, when I say question the whole society, it means ultimately coming to see that the problems of racism, the problem of economic exploitation, and the problem of war are all tied together.

-- Martin Luther King, Jr., "Where do we go from here?"

King's last, and most radical, Southern Christian Leadership Conference (SCLC) presidential addresshttp://en.wikipedia.org/wiki/Rollerball_(1975_film)

"In the film, the world of 2018 is a global corporate state, containing entities such as the Energy Corporation, a global energy monopoly based in Houston which deals with nominally-peer corporations controlling access to all Transport, Luxury, Housing, Communication, and Food on a global basis.""The first commandment of economics is: Grow. Grow forever. Companies get bigger. National economies need to swell by a certain percent each year. People should want more, make more, earn more, spend more - ever more.

The first commandment of the Earth is: enough. Just so much and no more. Just so much soil. Just so much water. Just so much sunshine. Everything born of the Earth grows to its appropriate size and then stops."

-- Donella Meadows

Co-Author, Limits to Growth"Capitalism can no more be 'persuaded' to limit growth than a human being can be 'persuaded' to stop breathing. Attempts to 'green' capitalism, to make it 'ecological', are doomed by the very nature of the system as a system of endless growth."

--Murray Bookchin"I believe that banking institutions are more dangerous to our liberties than standing armies. If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around the banks will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered."

-- Thomas Jefferson 1802as we move beyond the age of oil and beyond the economy that is driven by the age of oil, we enter an entirely new world - there really are frankly no experts anywhere who can come forward and say exactly what we do in this situation - it is entirely new to everybody's experience - there are no investors who can say this is a good investment in this situation, there are no politicians who can say this is how we should behave in this situation, even in a humble business way there is no business that can plan its future because every single aspect of its future is going to change and so we are left with a sort of vacuum

-- Colin Campbell, founder of the Association for the Study of Peak Oil www.peakoil.net

quoted in "Peak Oil: Imposed by Nature"Part of me wants to get all of Congress together, sit them all down, tape their eyelids open (like that scene in “A Clockwork Orange”), and force them to watch and listen to myriad lectures and presentations by folks who have a clear, non-ideologically tainted, non-partisan, mathematically-driven view of the current situation. I know, I’m silly. Because even THEN our representatives would still only act in accordance with how their most powerful and influential lobbyists ordered them to act ... regardless of the realities on the ground. And our representatives would vote to support or reject legislation NOT based upon what is correct vis-à-vis the numbers, but what is sure to get them the most votes during the next election cycle.

Saturday, January 24, 2009

Prestoopniks And Pretty Polly

http://ashizashiz.blogspot.com/2009/01/prestoopniks-and-pretty-polly.html

Sustainability requires a steady state economy

Sustainability means practices that can continue indefinitely - by definition that means zero fossil fuels, zero mining, no more population growth (and probably considerable gentle reduction in numbers). Nearly everything mentioned these days as “sustainability” is really just efficiency. A 100 mpg (or 42 kilometers per liter) car is efficient, but it is not sustainable. Even a bicycle using parts shipped across the ocean or a solar panel using energy intensive metallurgy might not be sustainable after the fossil fuel is burned.

Sustainability means practices that can continue indefinitely - by definition that means zero fossil fuels, zero mining, no more population growth (and probably considerable gentle reduction in numbers). Nearly everything mentioned these days as “sustainability” is really just efficiency. A 100 mpg (or 42 kilometers per liter) car is efficient, but it is not sustainable. Even a bicycle using parts shipped across the ocean or a solar panel using energy intensive metallurgy might not be sustainable after the fossil fuel is burned.

Many ecologically themed marketing efforts stress something called “the triple bottom line” - a campaign to get corporations and government to think more holistically. While it is certainly good to factor in environmental and social justice concerns, this paradigm is inadequate.

In reality, the environment makes society and the economy possible, these are not co-equal concepts. Energy creates money. It has been said that an economist is someone who thinks a tree can grow all the way to the moon if it is given enough money - without the natural world, the symbolic value of money is worthless.

Peak Money and the Global Financial Crash

a few sources on the interconnections between energy and the economy:

www.chrismartenson.com

Crash Course - energy, money, the crash

www.dieoff.org

Dieoff was one of the few websites about Peak Oil before 9/11, it is an excellent antidote to the wishful thinking that the "American Way of Life" (AWOL) can continue unabated after the oil is gone.

www.kunstler.com

James Howard Kunstler points out why we are not in a recession, it's not a big financial storm blowing through but more like climate change, a permanent condition

the economic crash and the misallocation of resources to unsustainable suburbia

www.steadystate.org

Center for the Advancement of the Steady State Economy

"A steady state economy can be compared to a mature forest ecosystem. The forest does not grow in aerial extent, but it is a complex, dynamic, and evolving system."

theautomaticearth.blogspot.com

comprehensive look at the global financial crash

ashizashiz.blogspot.com

Ashes Ashes All Fall Down

Colin Campbell, Association for the Study of Peak Oil

www.aspo-ireland.org/contentFiles/newsletterPDFs/newsletter95_200811.pdf

future historians will probably look back and see this as one of the great turning points for mankind. In short, debt has been premised on eternal economic growth based on flat-earth economic principles, without recognising that the growth depends on cheap energy that will no longer be available after the peak of oil production as imposed by Nature.

Michael C. Ruppert - mikeruppert.blogspot.com

the economic crash is deliberately being orchestrated (or at least intentionally manipulated) to reduce the demand for depleting energy resources

mikeruppert.blogspot.com/2008/10/many-of-my-predictions-about-us-govt.html

Michael Ruppert

Demand destruction is what this is all about, not just for oil but for almost all commodities. If (as an example) the world consumed 85 mbpd this year, the economic crash may result in demand reduction to 79-80 mbpd next year. Coincidentally, that will probably match what global decline rates allow the world to produce. The severity of the crash still in progress leads me to suspect that decline rates are actually much steeper than acknowledged.http://mikeruppert.blogspot.com/2008/10/number-of-mortgages-vs.html

With time I am more and more convinced that the Bushes et al have known that Peak Oil was coming for a long time and have planned to loot wealth, keeping it out of the hands of those who could/would use it constructively. Note that both economic crises happened at the very end of Bush regimes. It has been the"cashing-out" process for their "base".

The Oil Drum - www.theoildrum.com

best energy discussion forum on the internet, unfortunately discontinued in 2013 but the archives are still on line and extremely valuable

www.newsociety.com/bookid/3654

The Growth Illusion

How Economic Growth has Enriched the Few, Impoverished the Many, and Endangered the Planet

By Richard Douthwaite

www.conev.org/slackerspamphletnov08.pdf

The Slacker's Guide to Home Orcharding

by Alexis Zeigler

First Edition, October, 2008

The political resistance movements that developed in the twentieth century were adapted to conditions of economic growth. When an economy is growing, petitioning through political and legal means to assure increasing access to rights and wealth for traditionally disenfranchised groups met with a measure of success, and that success was the foundation for further movement building. Those movements cannot, as they are currently structured, guide us through the coming age.

Many of the problems that we see as having purely political roots are strongly influenced by economic and ecological factors. Social issues that may seem far apart, such as ecological stress and women's rights for instance, have common roots.

In the modern context, much of the political unraveling that we are witnessing can be understood in terms of the limitations of growth of modern industrialism.

The growth of fundamentalism and militarism, the decline of civil liberty and the environment, all of these problems are going to get worse if we do not find a new means to address them.

There are real solutions to these problems, but they are going to involve a quantum leap, both in thought and in action, beyond our current methods of political engagement. The solutions themselves are not even terribly difficult, they are simply well outside of our current range of vision and will.

http://resourceinsights.blogspot.com/2008/09/last-bailout.html

Published Sep 20 2008 by Resource Insights

The last bailout

by Kurt Cobb

While watching this week's turmoil in the world markets, I thought back to a piece Howard Odum wrote in 1974. In it he wrote:

Worldwide inflation is driven in part by the increasing fraction of our fossil fuels that have to be used in getting more fossil and other fuels. If the money circulating is the same or increasing, and if the quality [of] energy reaching society for its general work is less because so much energy has to go immediately into the energy-getting process, then the real work to society per unit [of] money circulated is less. Money buys less real work of other types and thus money is worth less. Because the economy and total energy utilization are still expanding, we are misled to think the total value is expanding and we allow more money to circulate which makes the money-to-work ratio even larger.

I think what we are seeing is the convergence of colossal financial mismanagement with energy stringency. Not surprisingly the authorities think that only money is the problem, i.e., there isn't enough of it available to fill the holes created by the disappearing value of various types of financial instruments. But if energy stringency is also part of the problem, then merely filling the financial voids with new money will only add fuel to the already potent inflationary mix which I fear is about to ignite.

In saying this, I offer no solution to the problem as stated. The real solution is much harder: deep cuts in energy use, rapid investment in and deployment of alternatives, reworking the infrastructure including agriculture for a low energy society. I'm under no illusion about whether such proposals will be made at the highest levels since there seems to be little awareness of our energy predicament.

I title this piece, "The Last Bailout," because if we are at peak, then financial bailouts will do little to help us. In the past when society had rising energy supplies with large energy profit ratios, these financial bailouts could avert disastrous consequences. They would allow the economy to regain its equilibrium and await the next sustained upturn. But, what if there is no next sustained upturn? If that turns out to be the case, then even if additional bailouts take place after today, they will all ultimately be lumped together into one, namely, the last bailout. And, the last bailout will of necessity fail to work as advertised.

Growth based economics vs. Sustainability - Steady State

Steady State Economics: The Center for the Advancement of the Steady

State Economy (CASSE) promote alternatives to the ecological insanity

of growth based economics. Read their position paper here:

www.steadystate.org/PositiononEG.html

www.steadystate.org

Center for the Advancement of the Steady State Economy

"A steady state economy can be compared to a mature forest ecosystem. The forest does not grow in aerial extent, but it is a complex, dynamic, and evolving system."

www.feasta.org/growth.htm - The Foundation for the Economics of Sustainability (Ireland)

www.growthbusters.com

Hooked on Growth: Our Misguided Quest for Prosperity

www.agoregon.org - Alternatives to Growth Oregon

a group focused on "growth" issues, they reached their own limits

to growth in 2004 (lots of good material on their archive site, worth

reading even though the organization no longer exists)

www.preservenet.com/endgrowth/

The End of Economic Growth by Charles Siegel

PreserveNet: urban planning, transportation and related issues.

The economist Herman Daly, who used to work for the World Bank, is one of the leading experts on how all economic systems are ultimately dependent on the environment for their existence. Official, corporatist economics (whether "socialist" or "capitalist") ignore resource issues in their calculations, assuming that increased costs always bring about more exploration to find more resources.

Most economists act as if a tree can grow all the way to the moon if you give it enough money.

dieoff.org/page37.htm

VALUING THE EARTH: Economics, Ecology, Ethics

Herman E. Daly and Kenneth N. Townsend (1993)

Sustainable Growth: An Impossibility Theorem

dieoff.org/page88.htm

STEADY-STATE ECONOMICS

By Herman Daly

dieoff.org/page41.htm

TOWARDS A NEW ECONOMICS:

Questioning Growth

by Herman E. Daly

www.hubbertpeak.com/hubbert/monetary.htm

"Two Intellectual Systems: Matter-energy and the Monetary Culture"

(summary, by M. King Hubbert)

excerpt from Richard Heinberg, "The Party's Over," pp. 91-92

Hubbert immediately grasped the vast economic and social implications of this information [Peak Oil]. He understood the role of fossil fuels in the creation of the modern industrial world, and thus foresaw the wrenching transition that would likely occur following the peak in global extraction rates. ...

The world's present industrial civilization is handicapped by the coexistence of two universal, overlapping, and incompatible intellectual systems: the accumulated knowledge of the last four centuries of the properties and interrelationships of matter and energy; and the associated monetary culture which has evolved from folkways of prehistoric origin.

The first of these two systems has been responsible for the spectacular rise, principally during the last two centuries, of the present industrial system and is essentially for its continuance. The second, an inheritance from the prescientific past, operates by rules of its own having little in common with those of the matter-energy system. Nevertheless, the monetary system, by means of a loose coupling, exercises a general control over the matter-energy system upon which it is superimposed.

Despite their inherent incompatibilities, these two systems during the last two centuries have had one fundamental characteristic in common, namely exponential growth, which has made a reasonably stable coexistence possible. But, for various reasons, it is impossible for the matter-energy system to sustain exponential growh for more than a few tens of doublings, and this phase is by now almost over. The monetary system has no such constraints, and, according to one of its most fundamental rules, it must continue to grow by compound interest.Hubbert thus believed that society, if it is to avoid chaos during the energy decline, must give up its antiquated, debt-and-interest-based monetary system and adopt a system of accounts based on matter-energy -- an inherently ecological system that would acknowledge the finite nature of essential resources.

Hubbert was quoted as saying we are in a "crisis in the evolution of human society. It's unique to both human and geologic history. It has never happened before and it can't possibly happen again. You can only use oil once. You can only use metals once. Soon all the oil is going to be burned and all the metals mined and scattered."

Statements like this one gave Hubbert the popular image of a doomsayer. Yet he was not a pessimist, indeed, on occasion he could assume the role of utopian seer. We have, he believed, the necessary know-how, all we need do is overhaul our culture and find an alternative to money. If society were to develop solar-energy technologies, reduce its population and its demands on resources, and develop a steady-state economy to replace the present one based on unending growth, our species' future could be rosy indeed. "We are not starting from zero," he emphasized. "We have an enormous amount of existing technical knowledge. It's just a matter of putting it all together. We still have great flexibility but our maneuverability will diminish with time."

[emphases added]

http://video.google.com/videoplay?docid=-9050474362583451279

Money As Debt

47 min - Feb 12, 2007

Smart Growth: having a nice seat on the Titanic

http://prorev.com/smartgrow.htm

WHY SMART GROWTH

ISN'T AS SMART

AS IT THINKS IT IS

Sam Smith

Growth (smart or dumb) is no longer possible

from an extraordinary interview with Matt Simmons, investment banker, friend of George W. Bush, member of Cheney's energy task force (in other words, he's NOT an environmentalist - but more aware of oil depletion than many environmental groups). How we as a civilization will cope with the end of the oil era when "western industrial civilization" is totally dependent on fossil fuel for agriculture is a much more important question than the illusion of "smart growth"

www.guerrillanews.com/sci-tech/doc2927.html

SIMMONS: This blackout ought to be an incredible jolt telling us about a host of energy problems that are ultimately going to prevent any future economic growth. ....

Simmons: I have for years described two camps: the economists who told us that technology would always produce new supply and the pessimists or Cassandras who told us that peak was coming in maybe fifteen or twenty years. We may be finding out that we went over the peak in 2000. That makes both camps wrong.

Over the last year. I have obtained and closely examined more than 100 very technical production reports from Saudi Arabia. What I glean from examining the data is that it is very likely that Saudi Arabia, already a debtor nation, has very likely gone over its Peak. If that is true, then it is a certainty that planet earth has passed its peak of production.

What that means, in the starkest possible terms, is that we are no longer going to be able to grow. It's like with a human being who passes a certain age in life. Getting older does not mean the same thing as death. It means progressively diminishing capacity, a rapid decline, followed by a long tail.

www.guardian.co.uk/comment/story/0,,2186525,00.html

In this age of diamond saucepans, only a recession makes sense

Economic growth is a political sedative, snuffing out protest as it drives inequality. It is time we gave it up

George Monbiot

Tuesday October 9, 2007

The Guardian

If you are of a sensitive disposition, I advise you to turn the page now. I am about to break the last of the universal taboos. I hope that the recession now being forecast by some economists materialises. I recognise that recession causes hardship. Like everyone I am aware that it would cause some people to lose their jobs and homes. I do not dismiss these impacts or the harm they inflict, though I would argue that they are the avoidable results of an economy designed to maximise growth rather than welfare. What I would like you to recognise is something much less discussed: that, beyond a certain point, hardship is also caused by economic growth.

On Sunday I visited the only biosphere reserve in Wales: the Dyfi estuary. As is usual at weekends, several hundred people had come to enjoy its beauty and tranquillity and, as is usual, two or three people on jet skis were spoiling it for everyone else. Most economists will tell us that human welfare is best served by multiplying the number of jet skis. If there are two in the estuary today, there should be four there by this time next year and eight the year after. Because the estuary's beauty and tranquillity don't figure in the national accounts (no one pays to watch the sunset) and because the sale and use of jet skis does, this is deemed an improvement in human welfare.

This is a minor illustration of an issue that can no longer be dismissed as trivial. In August the World Health Organisation released the preliminary results of its research into the links between noise and stress. Its work so far suggests that long-term exposure to noise from traffic alone could be responsible, around the world, for hundreds of thousands of deaths through ischaemic heart disease every year, as well as contributing to strokes, high blood pressure, tinnitus, broken sleep and other stress-related illnesses. Noise, researchers found, raises your levels of stress hormones even while you sleep. As a study of children living close to airports in Germany suggests, it also damages long-term memory, reading and speech perception. All over the world, complaints about noise are rising: to an alien observer it would appear that the primary purpose of economic growth is to find ever more intrusive means of burning fossil fuels.

This leads us to the most obvious way in which further growth will hurt us. Climate change does not lead only to a decline in welfare: beyond a certain point it causes its termination. In other words, it threatens the lives of hundreds of millions of people. However hard governments might work to reduce carbon emissions, they are battling the tide of economic growth. While the rate of growth in the use of energy declines as an economy matures, no country has yet managed to reduce energy use while raising gross domestic product. The UK's carbon dioxide emissions are higher than they were in 1997, partly as a result of the 60 successive quarters of growth that Gordon Brown keeps boasting about. A recession in the rich nations might be the only hope we have of buying the time we need to prevent runaway climate change.

The massive improvements in human welfare - better housing, better nutrition, better sanitation and better medicine - over the past 200 years are the result of economic growth and the learning, spending, innovation and political empowerment it has permitted. But at what point should it stop? In other words, at what point do governments decide that the marginal costs of further growth exceed the marginal benefits? Most of them have no answer to this question. Growth must continue, for good or ill. It seems to me that in the rich world we have already reached the logical place to stop.

I now live in one of the poorest places in Britain. The teenagers here have expensive haircuts, fashionable clothes and mobile phones. Most of those who are old enough have cars, which they drive incessantly and write off every few weeks. Their fuel bills must be astronomical. They have been liberated from the horrible poverty that their grandparents suffered, and this is something we should celebrate and must never forget. But with one major exception, can anyone argue that the basic needs of everyone in the rich nations cannot now be met?

The exception is housing, and in this case the growth in value is one of the reasons for exclusion. A new analysis by Goldman Sachs shows that current house prices are not just the result of a shortage of supply: if they were, then the rise in prices should have been matched by the rise in rents. Even taking scarcity into account, the analysts believe that houses are overvalued by some 20%.

Governments love growth because it excuses them from dealing with inequality. As Henry Wallich, a former governor of the US Federal Reserve, once pointed out in defending the current economic model: "Growth is a substitute for equality of income. So long as there is growth there is hope, and that makes large income differentials tolerable." Growth is a political sedative, snuffing out protest, permitting governments to avoid confrontation with the rich, preventing the construction of a just and sustainable economy. Growth has permitted the social stratification that even the Daily Mail now laments.

Is there anything that could sensibly be described as welfare that the rich can now gain? A month ago the Financial Times ran a feature on how department stores are trying to cater for "the consumer who has Arrived". But the unspoken theme of the article was that no one arrives - the destination keeps shifting. The problem, an executive from Chanel explained, is that luxury has been "over-democratised". The rich are having to spend more and more to distinguish themselves from the herd: in the United States the market in goods and services designed for this purpose is worth £720bn a year. To ensure that you cannot be mistaken for a lesser being, you can now buy gold-and-diamond saucepans from Harrods.

Without conscious irony, the FT article was illustrated with a photograph of a coffin. It turned out to be a replica of Lord Nelson's coffin, carved from wood taken from the ship on which he died, and yours for a fortune in a new, hyper-luxury department of Selfridges. Sacrificing your health and your happiness to earn the money to buy this junk looks like a sign of advanced mental illness.

Is it not time to recognise that we have reached the promised land, and should seek to stay there? Why would we want to leave this place in order to explore the blackened wastes of consumer frenzy followed by ecological collapse? Surely the rational policy for the governments of the rich world is now to keep growth rates as close to zero as possible?

But because political discourse is controlled by people who put the accumulation of money above all other ends, this policy appears to be impossible. Unpleasant as it will be, it is hard to see what except an accidental recession could prevent economic growth from blowing us through Canaan and into the desert on the other side.

www.kunstler.com/mags_diary22.html

November 12, 2007

Peak "Money"

James Howard Kunstler

The multi-dimensional meltdown underway in the finance sector illustrates perfectly how the complex systems we depend on start to wobble and fail as soon as peak oil establishes itself as a fact in the public imagination. Mainly what it shows is that we don't have to run out of oil -- or even come close to that -- before the trouble starts. Just going over the peak and heading down the slippery slope of depletion is enough. Peak oil, it turns out, is also peak money. Or should we say, peak "money?"

First of all, what is finance exactly? I'd bet that a lot of people these days don't know, including many working in the financial "industry," as it has taken to calling itself. Finance, until very recently, was the means by which investment was raised for useful economic activities and productive ventures -- in other words, the deployment of capital, which is to say accumulated wealth. Historically, this accumulated wealth was pretty meager. There wasn't a whole lot to deploy and the deployment was controlled by a tiny handful of people statistically greater only than the number of Martians in the general population. They operated as families or clans, and everybody knew who they were: the Medici, the Rothschilds. Even the Roman Empire was a kind of financial Flintstones operation compared to what we see on CNBC these days. Not having the printing press, the Romans had to inflate their currency the old-fashioned way, by adding base metals to their silver coins. Finance in the 200-odd-year-long industrial era evolved step-by-step with the steady incremental rise of available cheap energy. More to the point, the instruments associated with finance evolved in complexity with that rise in energy. It was only about two-hundred years ago, in fact, that circulating banknotes or paper currencies evolved out of much cruder certificates that were little more than IOUs. Once printed paper banknotes became established, and institutions created to regulate them, the invention of more abstract certificates became possible and we began to get things like stocks and bonds, traded publicly in bourses or exchanges, which represented amounts of money invested or loaned, but were not themselves "money."

Much of this innovation occurred during the rise of the coal-powered economy of the 19th century. It accelerated with the oil-and-gas economy of the 20th century, up into the present time. So, for about 150 years -- or roughly since the end of the American Civil War -- we've had a certain kind of regularized finance that enjoyed continual refinement. Even in the face of cyclical traumas, like the Great Depression, currencies, stocks, and bonds retained their legitimacy if not always their face value.

Russia was a bizarre exception. Crawling out of the mud of medievalism relatively late in the game, Russia pretended to abjure capital while still faced with the need to deploy it in industry. They solved this paradox conditionally by disqualifying the Russian public from participation in any part of the industrial economy except the hard work, and pretended to pay them in promises for "a brighter future," which never arrived as long as the Soviets remained in charge. (The Russian people repaid the system by only pretending to work.)

In any case, finance for the purpose of deploying capital has prevailed as reality among people who use the implements of the dinner table, but something weird has happened to it in recent years. It has entered a stage of grotesque, hypertrophic metastasis that now threatens the life of the industrial organism it evolved to serve. Its current state can be understood in direct relation to the run-up to peak oil (peak fossil fuel energy, really, since coal and gas figure into it, too). The oil age, we will soon discover, was an anomaly. Many of the things that seemed "normal" under its regime will turn out to have been rather special. And as the beginning of the end of the oil age becomes manifest, these special things are starting to self-destruct pretty spectacularly.

For one thing, finance in the past twenty years has evolved from being an organ serving a larger organism to taking over the organism, becoming a kind of blind, raging dominating parasite on its former host. Or to put it less hyperbolically, it has become an end in itself. That is what they mean when they say that the financial sector has been "driving" the economy. A feature of this ghastly process has been the evolution of financial instruments into ever more abstract entities removed from reality-based productive activities. Stocks and bonds were understood to represent direct investment in enterprise. Sometimes the enterprise was a failure, and sometimes the people running it were swindlers, but no one doubted that common stock represented the hope for profit in a particular venture like making steel or selling laxative chemicals. The new "creatively-innovated" financial "derivatives" of recent years are now so divorced from any real activities or product that often the people trafficking in them don't understand what they're supposed to represent. I'd bet that more than half the people in the New York Stock exchange any given day could not explain the meaning of a credit default swap if a Taliban were holding their oldest child over a window ledge across Wall Street.

The innovation of mutant financial "products" is a symptom of the "crack-up boom" that characterizes society's response to peak oil. The main implication of peak oil for an industrial economy is that the 200-odd-year-long expectation for continued regular growth in combined energy-activity-and-productivity at roughly 3 to 7 percent a year under "normal" conditions -- that expectation is now toast. Under the new regime of peak oil and its aftermath, regular energy depletion, society can expect no further industrial growth but only contraction, and all the certificates, instruments, and operations associated with the expectation for further industrial growth lose their legitimacy. Seen in this light, one can then understand the temporary value of these mutant financial derivatives. They allowed participants to conceal the fact that these "investments" were not directed at productive enterprise. They also provided a cohort of sharpies with "vehicles" for converting the leftovers of the industrial economy into assets for themselves -- a form of looting, really. Hence, the employees of Bear Stearns, Goldman Sachs, and Merrill Lynch gave themselves $50-million Christmas bonuses for trafficking in these inscrutable non-productive financial gimmicks, and were able to acquire fifty-room East hampton houses, Gulfstream jets, and impressionist paintings.

Of course, the aftermath might not be so pretty for these guys, since the next thing they may acquire could be long prison sentences. If they flee prosecution in their Gulfstream jets, they will not be able to take their Hamptons estates aboard with them. Those who remain may live to see mobs with flaming torches outside their windows, as in the "Frankenstein" movies of their suburban childhoods. But this has yet to play out.

For the moment it appears that we have entered the climax of the crack-up. The slick and inscrutable derivative vehicles infesting the ledgers of the investment banks, are now being systematically revealed as frauds of one kind or another, and, self-evidently lacking in worth. The process now underway is gruesome. The sheer dollar losses involved are almost as incomprehensible as the phony operations and instruments that they are derived from -- twelve billion here, nine billion there. As the late Senator Everett Dirkson once quipped, "sooner or later you're talking about real money...." Or are we? Is it money or "money." And if it's "money," what will become of it? And of us? How will it allow us to live?

www.theoildrum.com/node/2789#comment-214877

GreyZone on July 18, 2007 - 4:54pm | Permalink | Subthread

Global warming does not raise the specter of the end of growth. GW, to most of the population, seems like a problem that can be solved with some technical changes but no fundamental change to the infinite growth paradigm.

But you cannot go near peak oil without running smack into that question. Thus, peak oil is far more dangerous than global warming in the attitudes and expectations that it seems to foster.mr f on July 19, 2007 - 1:10am | Permalink | Subthread

Global warming does not raise the specter of the end of growth.Alas, NPC report is in accord with you. Interestingly, note how CC is used in this report not as a major problem to be dealt with, but something which will "lessen demand", and will diversify "alternative energy sources". They know the latter is bs, from a fiscal perspective--which is certainly Mr. Raymond's overriding concern, albeit the only meaningful perspective to take. They in essence say so much, under their breath, by not investing all that much in "alternatives" if you compare to hydrocarbon investments. "Lessen demand" is code for, if things do get hairy--we warned you may be driving too much! (Wow, talk about the pot calling the kettle black...) Mommy tells you "eat all the cookies you want" and then she leaves the room for a minute and comes back to find you sick and bloated from too many cookies she slaps you over the head and says "now if you want a cookie, it's gonna cost you--you know you want some more right? There are no shortages of cookies it's just now all your friends down the street want cookies, and there are evil-doers trying to blow up your cookies" etc etc... You get my drift.

I agree with Leanan* that they would sooner bring out the relatively minor boogeyman of global warming, than the stink bomb of peak oil (and these are all Big Oil guys!) Clearly, because CC is an ancillary issue. We "don't know what causes it" or "even if it is happening at all." Either way, it would cost too much money to fix, right? So fuck it all, BAU.

CC cannot be directly tied to "war" and "terrorism" (PO can). This maintains the facade, the disconnect, between war terrorism and oil. This is a critical distinction, the elephant in the room which our culture has somehow built up immunity too. "National Security", I believe the secret handshake goes...

Why would that be? The reason is pretty clear... CC and other "above ground security and political issues" will be the bellwether front for peak oil. It is far more comforting for businessmen and average Joe to think "well, these here economic problems are at root caused by 'terrorists' and the other ancillary affects of 'combating CC'" (a futile effort if I've ever seen one, one reason among a myriad that conservatives are so uber-cynical... anyone for throwing beach sand at waves? I'll take profits, thank you very much.) This is probably due to the fact that the markets need to be comforted, and even coming close to endorsing worst case scenarios for oil depletion would be tantamount to burning money (surely not something Mr. Raymond would want--can you sense my seething jealousy? ;] )

But you cannot go near peak oil without running smack into that question. Thus, peak oil is far more dangerous than global warming in the attitudes and expectations that it seems to foster.

This is why it is so easy to see how things are going to turn nasty quick, because when you can't even acknowledge a problem, then there is little chance of "fixing" it (particularly problems that seriously border on the insurmountable.) By definition, even if this so-called "progress" continues, actually addressing the root issue is an anathema to everything our society is and wants to be. Predictions are worth the price of storing them on a hard drive (hint: close to nothing) but I believe one can say fairly confidently that you will not hear these birds tweet 'uncle', ever. Why would you when you own everything and you can harp on about above ground issues?

mr f on July 18, 2007 - 9:27pm | Permalink | Subthread

One can't negotiate with a malignant psychology by trying to make it a friend... Just doesn't work. I'm young and have figured that out, and I believe you're older than me so you should know this doubly. You negotiate with malignant psychology by trying to remove it or reform it, unfortunately neither are really an option as these "things" are deeply entrenched and not going away short of a revolution (which would essentially mean the end of the civilization anyway, since we would be in fact toppling the very psychology that gave us all the wonders of "modern American life"). Perhaps you'll say I'm entering Doomer psychology, tweeting chicken little in my sleep... Although, I respect your attempt at some type of hopeful outcome, it is very unlikely that simply by "saying nice things" about these people that they'll somehow all of a sudden say "Gosh, you know what, you're right, we're just so wasteful, and this profit motive thing--what's that all about anyway?"I do agree with you though that one must forge on and keep tootin' the horn, no matter what happens. It's just, honestly, trying to wrangle the "higher-ups" is really a lost cause, like pissin' in the wind (or up a rope, take your pick).

From the bottom-up people will do what they find neccessary to prepare for whatever our future holds.

The top-down leadership of our country will do whatever they deem in the "interest" of the "country"--it matters little what you and I say--it's a large world out there (for now) and the people that "run it" are tasked with keeping themselves and their cronies happy. Lets see how long they can keep the jig up.

auntiegrav on July 18, 2007 - 10:15pm | Permalink | Subthread

One can't negotiate with a malignant psychology by trying to make it a friend... Just doesn't work.Ain't dat da troot, eh?

If there are a hundred people in a room, and only one person knows the right solution to a problem, any compromise will yield something less than solving the problem.

That's what we have now. The one solution is Demand Destruction, yet almost everyone in the room is trying to figure out how to compromise on that.I read an interview with a Conservative once who said, "If you want to change a conservative's mind, you only have to show them how to make more money doing it your way. The only way to change an intellectuals mind is to take it out and put in a different one."

This scenario doesn't work for either now, because 99% of the solutions require Conservatives to stop thinking in Perpetual Growth terms, and they require intellectuals to stop expecting to get grant money from the perpetual growth System.The Peak Oil scenario will hopefully be mitigated by demand destruction due to economic impact, but if global warming hits hard and fast "With Speed and Violence" (nod to Fred Pearce), then the resource demand may simply increase even more.

www.energybulletin.net/node/46564

Editorial Notes, Sept 19, 2008, Phil Henshaw

Money has to multiply for stability, and the earth can't.

What confuses things is the kind of signal the earth gives of trouble. The signal the earth gives is diminishing returns on our increasing efforts, that are only made worse by our redoubling our efforts. It's naturally confusing.

Here's my short course: Money will multiply as long as there are profits, because people with money multiply their own profits that way. As JM Keynes among others pointed out, when real productivity approaches limits, multiplying money will drive profits to zero. Driving profits to zero triggers waves of collapse, providing a means for our responding to our limits on earth.

It takes a little exploration to lead people to just how the present waves of money collapse are directly related to declines in the profitability of the earth, but that’s a major contributor and the first cause. Correcting the various immediate causes won’t fix that first cause. None of the other causes would have mattered if profits were still multiplying dramatically as compounding money needs to remain stable.

www.huffingtonpost.com/larisa-alexandrovna/welcome-to-the-final-stag_b_127990.html

Larisa Alexandrovna

Posted September 20, 2008

Welcome to the final stages of the coup...

In 2000, the long fought for and long admired democracy of the United States of America began a slow and steady decline toward fascism - a Bush family tradition - with the installment of a president - a man the citizens overwhelmingly rejected (although the funny math told a still believed myth) - by a few corrupt judges on the US Supreme Court. That coup is now nearly complete and checkmate is all but unavoidable.

Let me first point you to the Bush administration's so-called Wall Street bailout bill, here, so that you can see for yourself that this treachery is being conducted in the light of day. Fascism is finally and formally out of the right-wing closet even if the F word is not yet openly being used (although it should be, and often).

Now, if you do not yet understand that the Wall Street crisis is a man-made disaster done through intentional deregulation and corruption, I have a bridge in Alaska to sell to you (or Sara Palin does anyway). This manufactured crisis is now to be remedied, if the fiscal fascists get their way, with the total transfer of Congressional powers (the few that still remain) to the Executive Branch and the total transfer of public funds into corporate (via government as intermediary) hands.

http://jameshowardkunstler.typepad.com/clusterfuck_nation/2007/11/peak-money.html

PEAK MONEY

November 12, 2007

The multi-dimensional meltdown underway in the finance sector illustrates perfectly how the complex systems we depend on start to wobble and fail as soon as peak oil establishes itself as a fact in the public imagination. Mainly what it shows is that we don't have to run out of oil -- or even come close to that -- before the trouble starts. Just going over the peak and heading down the slippery slope of depletion is enough. Peak oil, it turns out, is also peak money. Or should we say, peak "money?"

www.davidstrahan.com/blog/?p=63

PEAK OIL MEANS PEAK ECONOMY - HIRSCH

Posted on Thursday, October 18th, 2007

(Podcast) When global oil production peaks, the economy is likely to shrink in direct proportion to dwindling fuel supplies, says Dr Robert Hirsch of the thinktank SAIC.

Speaking at the Association for the Study of Peak Oil conference in Houston, he also warned that as peak approaches, producer countries including OPEC and Russia are likely to husband their reserves for future generations and limit exports, potentially sharpening the decline in oil available to importing nations.

www.realitysandwich.com/money_and_crisis_civilization

------------------------------------------------------------------------------

No more will it be true that more for me is less for you.

------------------------------------------------------------------------------

Money and the Crisis of Civilization

Charles Eisenstein

Suppose you give me a million dollars with the instructions, "Invest this profitably, and I'll pay you well." I'm a sharp dresser -- why not? So I go out onto the street and hand out stacks of bills to random passers-by. Ten thousand dollars each. In return, each scribbles out an IOU for $20,000, payable in five years. I come back to you and say, "Look at these IOUs! I have generated a 20% annual return on your investment." You are very pleased, and pay me an enormous commission.

Now I've got a big stack of IOUs, so I use these "assets" as collateral to borrow even more money, which I lend out to even more people, or sell them to others like myself who do the same. I also buy insurance to cover me in case the borrowers default -- and I pay for it with those self-same IOUs! Round and round it goes, each new loan becoming somebody's asset on which to borrow yet more money. We all rake in huge commissions and bonuses, as the total face value of all the assets we've created from that initial million dollars is now fifty times that.

Then one day, the first batch of IOUs comes due. But guess what? The person who scribbled his name on the IOU can't pay me back right now. In fact, lots of the borrowers can't. I try to hush this embarrassing fact up as long as possible, but pretty soon you get suspicious. You want your million dollars back -- in cash. I try to sell the IOUs and their derivatives that I hold, but everyone else is suspicious too, and no one buys them. The insurance company tries to cover my losses, but it can only do so by selling the IOUs I gave it!

So finally, the government steps in and buys the IOUs, bails out the insurance company and everyone else holding the IOUs and the derivatives stacked on them. Their total value is way more than a million dollars now. I and my fellow entrepreneurs retire with our lucre. Everyone else pays for it.

This is the first level of what has happened in the financial industry over the past decade. It is a huge transfer of wealth to the financial elite, to be funded by US taxpayers, foreign corporations and governments, and ultimately the foreign workers who subsidize US debt indirectly via the lower purchasing power of their wages. However, to see the current crisis as merely the result of a big con is to miss its true significance.

I think we all sense that we are nearing the end of an era. On the most superficial level, it is the era of unregulated casino-style financial manipulation that is ending. But the current efforts of the political elites to fix the crisis at this level will only reveal its deeper dimensions. In fact, the crisis goes "all the way to the bottom." It arises from the very nature of money and property in the world today, and it will persist and continue to intensify until money itself is transformed. A process centuries in the making is in its final stages of unfoldment.

Money as we know it today has crisis and collapse built into its basic design. That is because money seeks interest, bears interest, and indeed is born of interest. To see how this works, let's go back to some finance basics. Money is created when somebody takes out a loan from a bank (or more recently, a disguised loan from some other kind of institution). A debt is a promise to pay money in the future in order to buy something today; in other words, borrowing money is a form of delayed trading. I receive something now (bought with the money I borrowed) and agree to give something in the future (a good or service which I will sell for the money to pay back the debt). A bank or any other lender will ordinarily only agree to lend you money if there is a reasonable expectation you will pay it back; in other words, if there is a reasonable expectation you will produce goods or services of equivalent value. This "reasonable expectation" can be guaranteed in the form of collateral, or it can be encoded in one's credit rating.

Any time you use money, you are essentially guaranteeing "I have performed a service or provided a good of equivalent value to the one I am buying." If the money is borrowed money, you are saying that you will provide an equivalent good/service in the future.

Now enter interest. What motivates a bank to lend anyone money in the first place? It is interest. Interest drives the creation of money today. Any time money is created through debt, a need to create even more money in the future is also created. The amount of money must grow over time, which means that the volume of goods and services must grow over time as well.

If the volume of money grows faster than the volume of goods and services, the result is inflation. If it grows more slowly -- for example through a slowdown in lending -- the result is bankruptcies, recession, or deflation. The government can increase or decrease the supply of money in several ways. First, it can create money by borrowing it from the central bank, or in America, from the Federal Reserve. This money ends up as bank deposits, which in turn give banks more margin reserves on which to extend loans. You see, a bank's capacity to create money is limited by margin reserve requirements. Typically, a bank must hold cash (or central bank deposits) equal to about 10% of its total customer deposits. The other 90%, it can loan out, thus creating new money. This money ends up back in a bank as deposits, allowing another 81% of it (90% of 90%) to be lent out again. In this way, each dollar of initial deposits ends up as $9 of new money. Government spending of money borrowed from the central bank acts a seed for new money creation. (Of course, this depends on banks' willingness to lend! In a credit freeze such as happened this week, banks hoard excess reserves and the repeated injections of government money have little effect.)

Another way to increase the money supply is to lower margin reserve requirements. In practice this is rarely done, at least directly. However, in the last decade, various kinds of non-bank lending have skirted the margin reserve requirement, through the alphabet soup of financial instruments you've been hearing about in the news. The result is that each dollar of original equity has been leveraged not to nine times it original value, as in traditional banking, but to 70 times or even more. This has allowed returns on investment far beyond the 5% or so available from traditional banking, along with "compensation" packages beyond the dreams of avarice.

Each new dollar that is created comes with a new dollar of debt -- more than a dollar of debt, because of interest. The debt is eventually redeemed either with goods and services, or with more borrowed money, which in turn can be redeemed with yet more borrowed money... but eventually it will be used to buy goods and services. The interest has to come from somewhere. Borrowing more money to make the interest payments on an existing loan merely postpones the day of reckoning by deferring the need to create new goods and services.

The whole system of interest-bearing money works fine as long as the volume of goods and services exchanged for money keeps growing. The crisis we are seeing today is in part because new money has been created much faster than goods and services have, and much faster than has been historically sustainable. There are only two ways out of such a situation: inflation and bankruptcies. Each involve the destruction of money. The current convulsions of the financial and political elites basically come down to a futile attempt to prevent both. Their first concern is to prevent the evaporation of money through massive bankruptcies, because it is, after all, their money.

There is a much deeper crisis at work as well, a crisis in the creation of goods and services that underlies money to begin with, and it is this crisis that gave birth to the real estate bubble everyone blames for the current situation. To understand it, let's get clear on what constitutes a "good" or a "service." In economics, these terms refer to something that is exchanged for money. If I babysit your children for free, economists don't count it as a service. It cannot be used to pay a financial debt: I cannot go to the supermarket and say, "I watched my neighbor's kids this morning, so please give me food." But if I open a day care center and charge you money, I have created a "service." GDP rises and, according to economists, society has become wealthier.

The same is true if I cut down a forest and sell the timber. While it is still standing and inaccessible, it is not a good. It only becomes "good" when I build a logging road, hire labor, cut it down, and transport it to a buyer. I convert a forest to timber, a commodity, and GDP goes up. Similarly, if I create a new song and share it for free, GDP does not go up and society is not considered wealthier, but if I copyright it and sell it, it becomes a good. Or I can find a traditional society that uses herbs and shamanic techniques for healing, destroy their culture and make them dependent on pharmaceutical medicine which they must purchase, evict them from their land so they cannot be subsistence farmers and must buy food, clear the land and hire them on a banana plantation -- and I have made the world richer. I have brought various functions, relationships, and natural resources into the realm of money. In The Ascent of Humanity I describe this process in depth: the conversion of social capital, natural capital, cultural capital, and spiritual capital into money.

Essentially, for the economy to continue growing and for the (interest-based) money system to remain viable, more and more of nature and human relationship must be monetized. For example, thirty years ago most meals were prepared at home; today some two-thirds are prepared outside, in restaurants or supermarket delis. A once unpaid function, cooking, has become a "service". And we are the richer for it. Right?

Another major engine of economic growth over the last three decades, child care, has also made us richer. We are now relieved of the burden of caring for our own children. We pay experts instead, who can do it much more efficiently.

In ancient times entertainment was also a free, participatory function. Everyone played an instrument, sang, participated in drama. Even 75 years ago in America, every small town had its own marching band and baseball team. Now we pay for those services. The economy has grown. Hooray.

The crisis we are facing today arises from the fact that there is almost no more social, cultural, natural, and spiritual capital left to convert into money. Centuries, millennia of near-continuous money creation has left us so destitute that we have nothing left to sell. Our forests are damaged beyond repair, our soil depleted and washed into the sea, our fisheries fished out, the rejuvenating capacity of the earth to recycle our waste saturated. Our cultural treasury of songs and stories, images and icons, has been looted and copyrighted. Any clever phrase you can think of is already a trademarked slogan. Our very human relationships and abilities have been taken away from us and sold back, so that we are now dependent on strangers, and therefore on money, for things few humans ever paid for until recently: food, shelter, clothing, entertainment, child care, cooking. Life itself has become a consumer item. Today we sell away the last vestiges of our divine bequeathment: our health, the biosphere and genome, even our own minds. This is the process that is culminating in our age. It is almost complete, especially in America and the "developed" world. In the developing world there still remain people who live substantially in gift cultures, where natural and social wealth is not yet the subject of property. Globalization is the process of stripping away these assets, to feed the money machine's insatiable, existential need to grow. Yet this stripmining of other lands is running up against its limits too, both because there is almost nothing left to take, and because of growing pockets of effective resistance.

The result is that the supply of money -- and the corresponding volume of debt -- has for several decades outstripped the production of goods and services that it promises. It is deeply related to the classic problem of oversupply in capitalist economics. The Marxian crisis of capital can be deferred into the future as long as new, high-profit industries and markets can be developed to compensate for the vicious circle of falling profits, falling wages, depressed consumption, and overproduction in mature industries. The continuation of capitalism as we know it depends on an infinite supply of these new industries, which essentially must convert infinite new realms of social, natural, cultural, and spiritual capital into money. The problem is, these resources are finite, and the closer they contemporaneous with the financial crisis we have an ecological crisis and a health crisis. They are intimately interlinked. We cannot convert much more of the earth into money, or much more of our health into money, before the basis of life itself is threatened.

Faced with the exhaustion of the non-monetized commonwealth that it consumes, financial capital has tried to delay the inevitable by cannibalizing itself. The dot-com bubble of the late 90s showed that the productive economy could not longer keep up with the growth of money. Lots of excess money was running around frantically, searching for a place where the promise of deferred goods and services could be redeemed. So, to postpone the inevitable crash, the Fed slashed interest rates and loosened monetary policy to allow old debts to be repaid with new debts (rather than real goods and services). The new financial goods and services that arose were phony, artifacts of deceptive accounting on a vast, systemic scale.

Obviously, the practice of borrowing new money to pay the principal and interest of old debts cannot last very long, but that is what the economy as a whole has done for ten years now. Unfortunately, simply stopping this practice isn't going to solve the underlying problem. A collapse is coming, unavoidably. The government's bailout plan will at best postpone it for a year or two (who knows, maybe until 2012!), long enough for the big players to move their money to a safe haven. They will discover, though, that there is no safe haven. As the US dollar loses its safe-haven status (which will happen all the more certainly when the government takes over Wall Street's bad debts), you can expect capital to chase various commodities in an inflationary surge before a deflationary depression takes hold. If a credit freeze overpowers the government's inflationary measures, depression will come all the sooner.

The present crisis is actually the final stage of what began in the 1930s. Successive solutions to the fundamental problem of keeping pace with money that expands with the rate of interest have been applied, and exhausted. The first effective solution was war, a state which has been permanent since 1940. Nuclear weapons and a shift in human consciousness have limited the solution of endless military escalation. Other solutions -- globalization, technology-enabled development of new goods and services to replace human functions never before commoditized, and technology-enabled plunder of natural resources once off limits, and finally financial auto-cannibalism -- have similarly run their course. Unless there are realms of wealth I have not considered, and new depths of poverty, misery, and alienation to which we might plunge, the inevitable cannot be delayed much longer.

In the face of the impending crisis, people often ask what they can do to protect themselves. "Buy gold? Stockpile canned goods? Build a fortified compound in a remote area? What should I do?" I would like to suggest a different kind of question: "What is the most beautiful thing I can do?" You see, the gathering crisis presents a tremendous opportunity. Deflation, the destruction of money, is only a categorical evil if the creation of money is a categorical good. However, you can see from the examples I have given that the creation of money has in many ways impoverished us all. Conversely, the destruction of money has the potential to enrich us. It offers the opportunity to reclaim parts of the lost commonwealth from the realm of money and property.

We actually see this happening every time there is an economic recession. People can no longer pay for various goods and services, and so have to rely on friends and neighbors instead. Where there is no money to facilitate transactions, gift economies reemerge and new kinds of money are created. Ordinarily, though, people and institutions fight tooth and nail to prevent that from happening. The habitual first response to economic crisis is to make and keep more money -- to accelerate the conversion of anything you can into money. On a systemic level, the debt surge is generating enormous pressure to extend the commodification of the commonwealth. We can see this happening with the calls to drill for oil in Alaska, commence deep-sea drilling, and so on. The time is here, though, for the reverse process to begin in earnest -- to remove things from the realm of goods and services, and return them to the realm of gifts, reciprocity, self-sufficiency, and community sharing. Note well: this is going to happen anyway in the wake of a currency collapse, as people lose their jobs or become too poor to buy things. People will help each other and real communities will reemerge.

In the meantime, anything we do to protect some natural or social resource from conversion into money will both hasten the collapse and mitigate its severity. Any forest you save from development, any road you stop, any cooperative playgroup you establish; anyone you teach to heal themselves, or to build their own house, cook their own food, make their own clothes; any wealth you create or add to the public domain; anything you render off-limits to the world-devouring machine, will help shorten the Machine's lifespan. Think of it this way: if you already do not depend on money for some portion of life's necessities and pleasures, then the collapse of money will pose much less of a harsh transition for you. The same applies to the social level. Any network or community or social institution that is not a vehicle for the conversion of life into money will sustain and enrich life after money.

In previous essays I have described alternative money systems, based on mutual credit and demurrage, that do not drive the conversion of all that is good, true, and beautiful into money. These enact a fundamentally different human identity, a fundamentally different sense of self, from what dominates today. No more will it be true that more for me is less for you. On a personal level, the deepest possible revolution we can enact is a revolution in our sense of self, in our identity. The discrete and separate self of Descartes and Adam Smith has run its course and is becoming obsolete. We are realizing our own inseparateness, from each other and from the totality of all life. Interest denies this union, for it seeks growth of the separate self and the expense of something external, something other. Probably everyone reading this essay agrees with the principles of interconnectedness, whether from a Buddhistic or an ecological perspective. The time has come to live it. It is time to enter the spirit of the gift, which embodies the felt understanding of non-separation. It is becoming abundantly obvious that less for you (in all its dimensions) is also less for me. The ideology of perpetual gain has brought us to a state of poverty so destitute that we are gasping for air. That ideology, and the civilization built upon it, is what is collapsing today.

Individually and collectively, anything we do to resist or postpone the collapse will only make it worse. So stop resisting the revolution in human beingness. If you want to survive the multiple crises unfolding today, do not seek to survive them. That is the mindset of separation; that is resistance, a clinging to a dying past. Instead, allow your perspective to shift toward reunion, and think in terms of what you can give. What can you contribute to a more beautiful world? That is your only responsibility and your only security. The gifts you need to survive and enjoy will come to you easily, because what you do to the world, you do to yourself.